Depending on the nature and objectives of the business, different types of cost objects can be chosen and customized to suit the specific needs and requirements of the cost analysis. The main goal of using cost objects is to provide relevant and accurate information for decision making and performance evaluation. In practice, there are several costing uber turbotax discounts and service codes methods used to allocate indirect costs, such as activity-based costing (ABC) or fixed cost classification. Each method has its own pros and cons, for example in terms of impact on pricing, financial reporting and taxation. Standard costing is a method of allocation that assigns costs to cost objects based on predetermined standards or estimates.

Cost Object: How to Define and Trace Costs to a Specific Product: Service: or Activity

Examples of direct costs include direct materials, direct labor, and other costs incurred for a particular product such as advertising and promotion costs for, say “Product A”. Working with a professional accountant can guide businesses on best practices for using cost objects. An experienced accountant can also help businesses identify areas for improvement and implement effective cost-management strategies. For example, customer acquisition costs, which refer to acquiring new customers, can be useful for businesses looking to expand their customer base. Similarly, employee-related costs, such as salaries, benefits, and training expenses, can be tracked as a cost object to help businesses understand the true cost of their workforce.

Is there any other context you can provide?

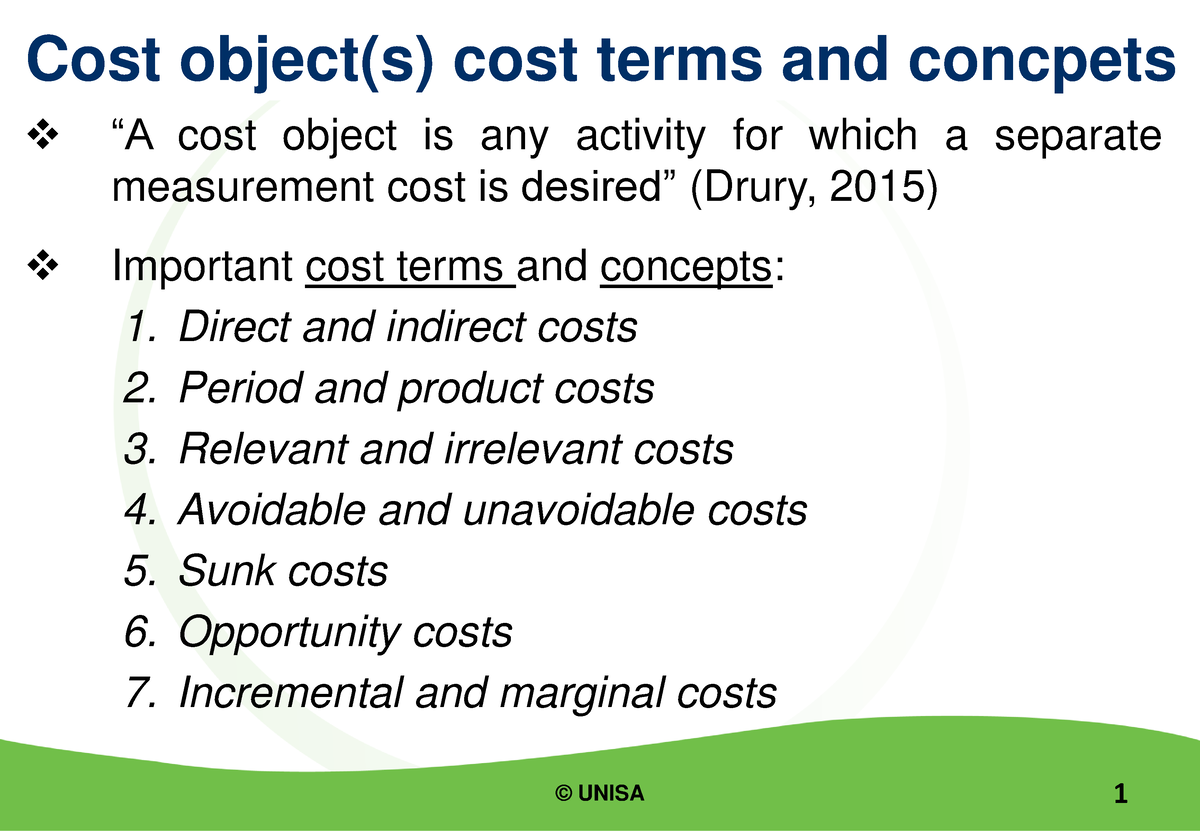

Cost objects are any products, services, or activities that incur costs and for which managers need to measure and control costs. Cost tracing is the process of assigning direct costs to the cost objects that cause them, while cost allocation is the process of distributing indirect costs to the cost objects that benefit from them. In this section, we will discuss some of the cost tracing techniques that can help managers allocate costs more precisely and fairly. By defining and tracing costs to cost objects, managers can monitor and compare the costs incurred for each cost object, and identify the sources of inefficiencies, waste, or overruns. This can help them implement corrective actions, reduce unnecessary costs, and optimize the use of resources.

- We will also discuss the challenges businesses may face when assigning costs and provide examples of cost objects used in the manufacturing industry.

- Finally, you should be able to apply the concept of cost object to different scenarios and situations in your own context.

- Cost object management can also help businesses to reduce their costs and increase their revenues.

- The cleaning crew that cleans the plant would also be indirect labor, as would the maintenance crew that handles repairs for the plant.

Presentation: How are direct and indirect costs reported on an income statement?

It can be a product, service, project, department, customer, or any other entity that requires resources and generates costs. We will also answer frequently asked questions, including who assigns costs to cost objects and why we assign them. We will also discuss the challenges businesses may face when assigning costs and provide examples of cost objects used in the manufacturing industry. The steel and bolts needed for the production of a car or truck would be classified as direct costs. Although the electricity expense can be tied to the facility, it can’t be directly tied to a specific unit and is, therefore, classified as indirect.

Accountants can look at the expenses or outlays of cash and figure out where it was spent and why. By defining cost objects for each product line, the company can determine the cost of producing each product, identify the most profitable lines, and allocate resources accordingly. This information helps the company optimize its product portfolio and maximize profitability. The most common examples of indirect costs include the following expenditures, assuming they are not specific to a cost object, such as a product, service, department or project. Job order costing is a cost allocation method used in manufacturing companies that produce custom or unique products.

What Is a Cost Object and How Is It Defined in Accounting and Finance? – Understanding Cost Objects

Businesses should regularly review their cost objects, cost drivers, and cost allocation methods, and make adjustments as needed. They should also use feedback and data to evaluate the effectiveness of their cost object management and identify the areas for improvement. By doing so, businesses can achieve their goals and objectives, and create a competitive advantage in the market. One of the main objectives of cost accounting is to assign costs to different products, services, or activities that an organization performs. These are called cost objects, and they can vary depending on the nature and purpose of the business. For example, a cost object could be a product line, a customer segment, a project, or a department.

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. One of the most crucial decisions that a business can make is whether to expand into foreign… In the realm of business, the ability to effectively analyze and utilize lead data stands as a…

If TechGadget Co. decided to stop producing smartwatches, it would save the $360,000 in traceable costs related to this product. On the other hand, indirect costs, such as the factory rent, administrative salaries, and other overheads, would still remain and need to be allocated to the remaining product(s). These costs are commonly shared by multiple products, different departments, or branches; hence, such costs cannot practically be traced to a cost object. Cost object definition and measurement are essential for cost accounting and management. They can help us determine the cost and profitability of different units of activity and support our decision making and improvement.

The company uses cost object information to determine the profitability and contribution margin of each product, and to make strategic decisions about product mix, pricing, and promotion. The company also uses cost object information to evaluate its production efficiency and quality, and to implement continuous improvement initiatives. Another challenge businesses face when assigning costs to cost objects is allocating indirect costs. Indirect costs, such as overhead or administrative expenses, can be difficult to allocate to specific cost objects. Businesses may need to use allocation methods, such as activity-based costing, to allocate indirect costs to cost objects. It can be a product, a service, a project, a customer, a department, or any other unit of activity.

Direct and indirect costs are the two major types of expenses or costs that companies can incur. Direct costs are often variable costs, meaning they fluctuate with production levels such as inventory. However, some costs, such as indirect costs are more difficult to assign to a specific product.