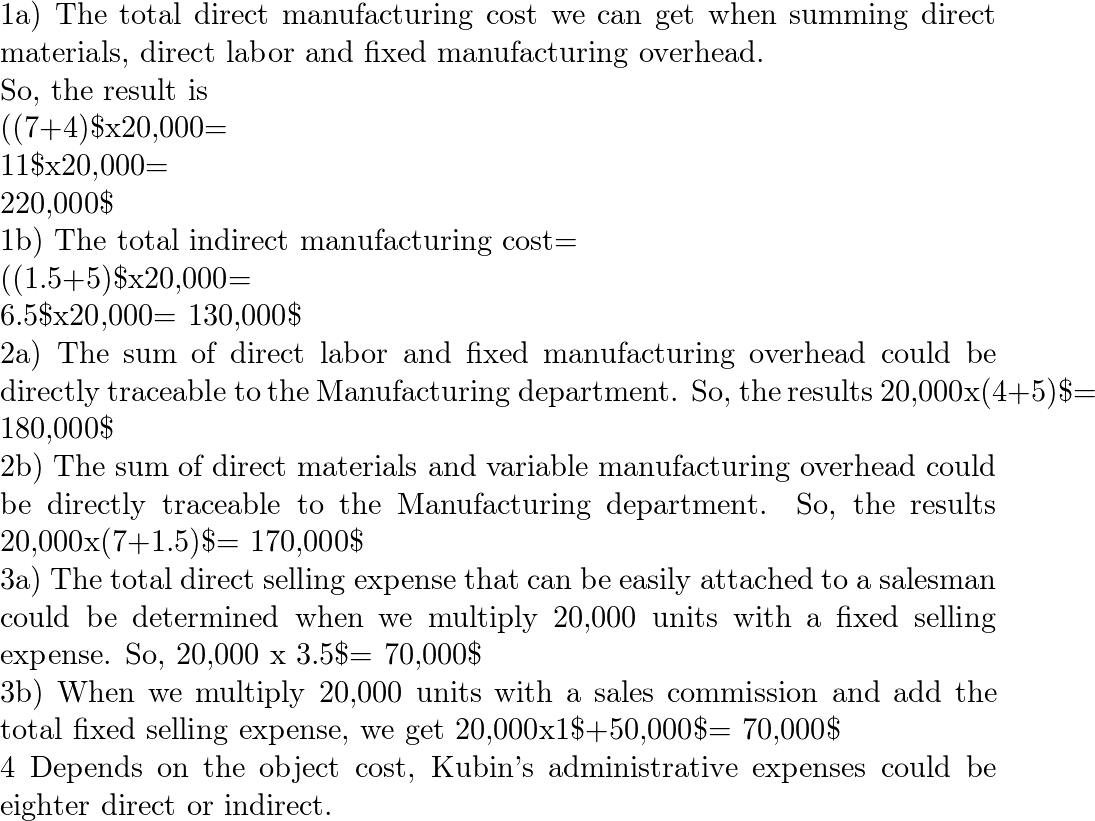

Although most direct costs tend to be variable, there are exceptions to the rule and some direct costs may be considered fixed. Cost objects help businesses reduce their costs by identifying areas where they may be able to streamline their operations or reduce waste. The division manager or department manager will typically have control over their direct costs.

Measurement & Valuation: How to allocate direct and indirect expenses?

For example, a business may incur some direct labor costs even if it does not sell a single product/service. This information can then be used to determine the true cost of each bicycle and make more informed decisions about pricing, production processes, and resource allocation. Businesses must clearly understand their costs as they strive to make informed financial decisions. Using direct costs requires strict management of inventory valuation when inventory is purchased at different dollar amounts.

Pricing & Profitability

This can help them align the prices with the value delivered to the customers, and ensure that the prices cover the costs and generate a reasonable margin. For example, a service company can define and trace the costs of labor, materials, and overheads for each service offered, and calculate the cost per hour or per project. This can help them charge premier online customer ratings and product reviews competitive and fair prices, and assess the profitability of each service or customer segment. Contrastingly, common costs, also known as indirect costs or allocated costs, can’t be traced directly to a single cost object. Examples include the salaries of corporate executives or the utilities for a factory that produces multiple products.

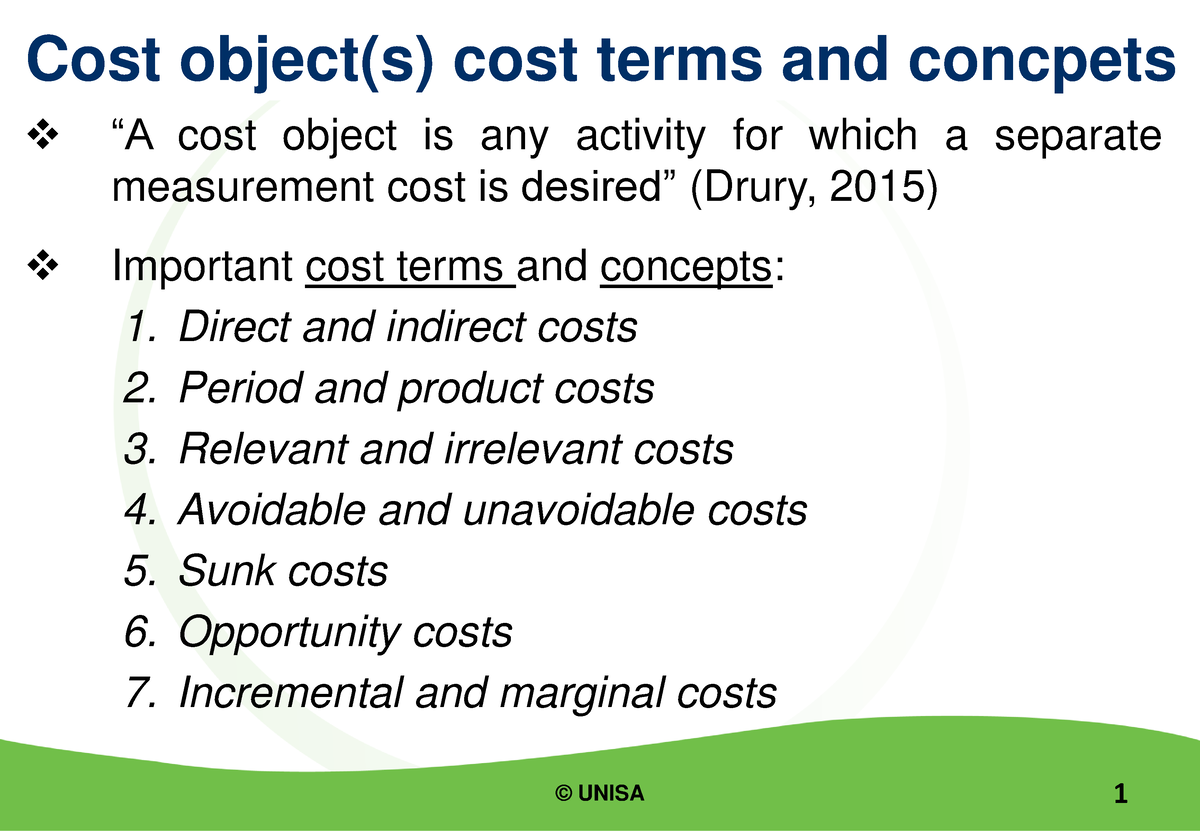

- In this section, we will explore the concept of cost object in more detail and learn how to define and trace costs to a specific cost object.

- The hospital also uses cost object information to optimize its resource allocation and capacity planning, and to enhance its patient satisfaction and loyalty.

- By understanding the cost of each supplier, manufacturers can negotiate better pricing, improve supplier relationships, and reduce supply chain risks.

- We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources.

Example of Traceable Costs

That is, some costs which are indirect for a product, may be traced to a segment or department and thus, will be direct costs for that department. A segment may mean any one of a number of things, viz., department, division, specific activity, sales territory and the like. For example, the salary of the plant manager of Plant A is a direct cost of plant A.

Fixed vs. Variable

For example, suppose the company identifies that the cost of producing the mid-range smartphone is higher than expected. It is worth noting that cost assignment is a general term for assigning costs, whether direct or indirect, to a cost object. Managerial accounting is the art of planning, decision making, and controlling in business and the cost object helps us assign cost. Are we looking at a product, a store, a department within the company, or even a customer? Since managerial accounting gives us so much flexibility, we need to make sure we understand what we want to assign costs. Costs also may be direct or indirect with respect to particular company segments or divisions.

However, larger businesses may also have more resources and specialized personnel to manage and allocate costs to cost objects. They may instead be attributable to multiple projects or are incurred to support overall operations. When building financial models or understanding managerial accounting, direct costs are a component that helps managers and entrepreneurs alike make sound business decisions. Activities can also serve as cost objects, representing specific actions or processes within a company.

However, it is essential to consider the challenges that may arise when assigning costs to cost objects and to review and update the allocation methods used regularly. In conclusion, understanding cost objects is a crucial aspect of cost accounting and finance for any business. It allows for effective cost management and decision-making, enabling companies to accurately track expenses and allocate costs to the appropriate sources. Because direct costs can be specifically traced to a product, direct costs do not need to be allocated to a product, department, or other cost objects.

They are considered to be part of the cost of production, along with variable costs, and are therefore used in the calculation of total cost. Variable costing is a method of allocation that assigns only variable costs to a specific cost object, such as direct materials, direct labor, and variable overhead. If a company receives government funding, it may be the case that the government provides guidelines with the funding. The guidelines may include instructions on cost reporting and which expenses constitute a direct or indirect cost as a requirement for obtaining the loan. In such a scenario, understanding which costs constitute direct and indirect costs can make it critical to maintain or gain additional funding. Direct costs are a cost that can be easily traced to a specific product or service while indirect costs cannot be easily traced.

Some businesses may have complex operations, making assigning costs to cost objects challenging. For example, assigning costs to cost objects can become complex if a business operates in multiple locations or has multiple product lines. Businesses may need sophisticated cost allocation methods or software to handle this complexity.

Cost objects are essential elements in determining and allocating costs within an organization. Indirect costs would be the utilities, administrative and marketing expenses and salaries involved in running of the overall business that cannot be easily assigned to a specific car production unit. Firstly, smaller businesses may have fewer cost objects than larger firms, as they may have a simpler organizational structure and product/service offerings. This can make it easier for them to assign and track costs, as there are fewer cost objects to manage. Cost objects can be used to track the cost of specific projects, such as new product development, process improvement, or facility upgrades.